Risk limit for traders (Master accounts)

Note

How to sell it to a client

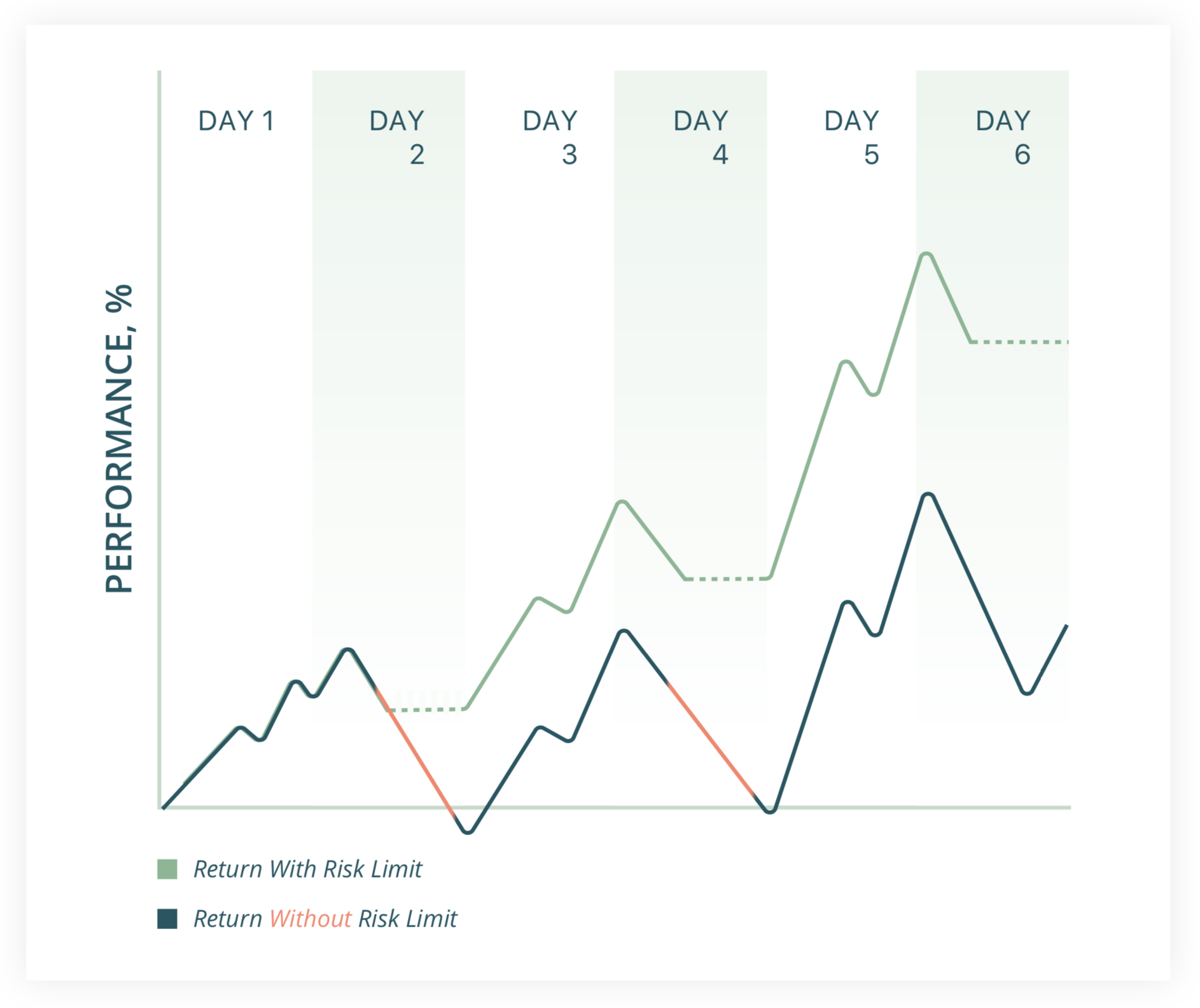

Daily Risk Limit is automated risk manager for every trader in Social Trading / MAM / PAMM. Every professional trader in hedge fund has its own so do you.

How it works

This risk limit is a daily risk limit. It resets every day.

It is calculated as a % from equity at the beginning of each day (00.00 MT server time).

After it reached, investment platform closes all opened positions and blocks account till next trading day (00.00 MT server time).

Note

Daily risk limit for traders helps them to protect their accounts from huge losses in a single bad day.

Formula

Risk_Limit_Signal_Equity = Equity_daystart x (1-RL%)

Equity_daystart - equity of account at

00.00MT server timeRL% - risk limit in %

If equity of account is lower than Risk_Limit_Signal_Equity - then all positions will be closed and account will be turned into read-only till 00.00 MT server time.

How deposits/withdrawals affect risk limit

Note

Equity_daystart is adjusted by new Deposits/Withdrawals during the day. So withdrawal will not trigger the risk limit.

But as soon as Equity_daystart_afterwithdrawal will be smaller than equity_daystart_before_withdrawal, risk limit in $$$ will be also changed as after withdrawal.

The formula

Equity_daystart_afterwithdrawal = Equity_daystart - withdrawal_amount

so the signal equity will also be changed → → →

Risk_Limit_Signal_Equity_afterwithdrawal = Equity_daystart_afterwithdrawal x (1-RL%)