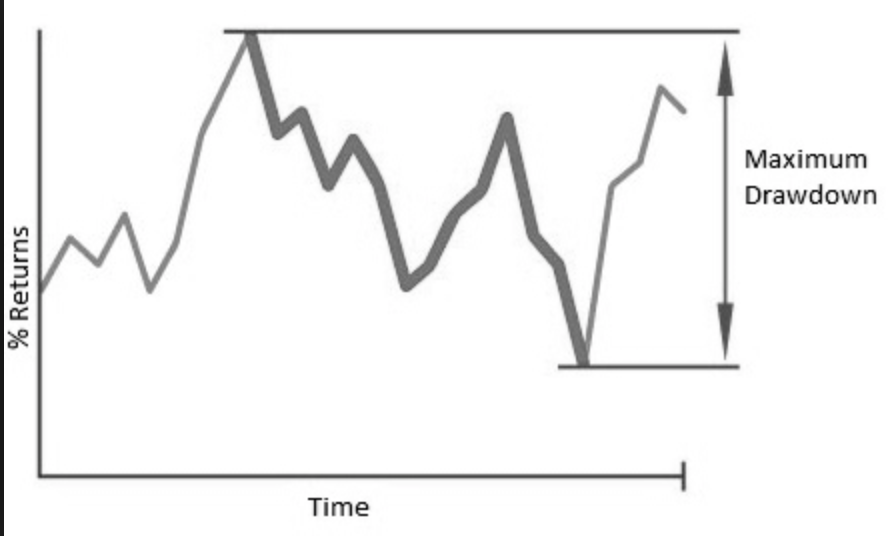

How the maximum drawdown parameter is calculated

Maximum drawdown is the maximum observed loss from a peak to a bottom of a portfolio, before a new peak is attained. Maximum drawdown is an indicator of downside risk over a specified time period.

It shows the maximum potential risks of investor in % through the period if he invested at peak and withdrawn all money on the bottom.

Note

How can it be used in sales?

When investor thinks about investing in a strategy, he needs to be prepared to hold a risk not less than previous reached Maximum Drawdown.

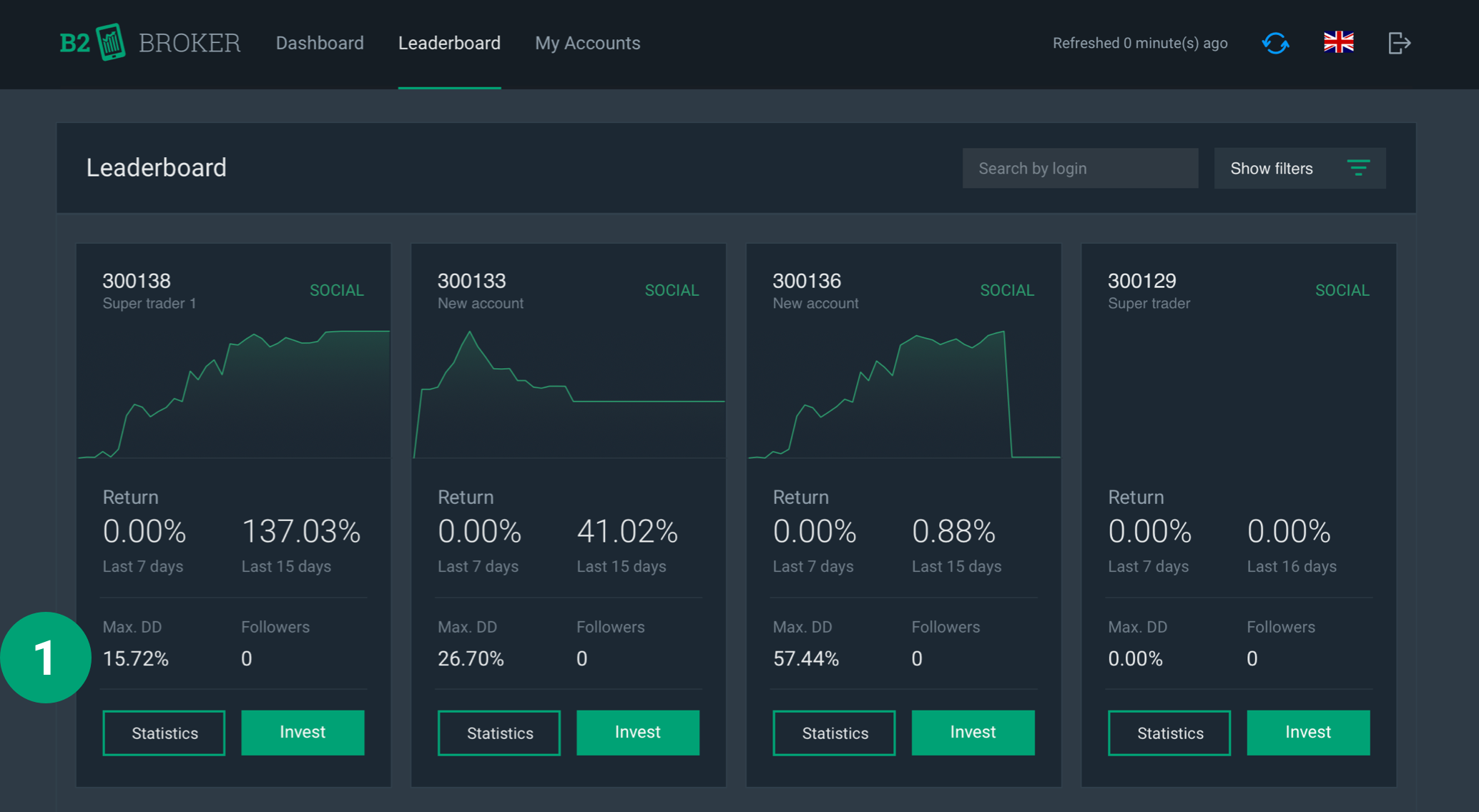

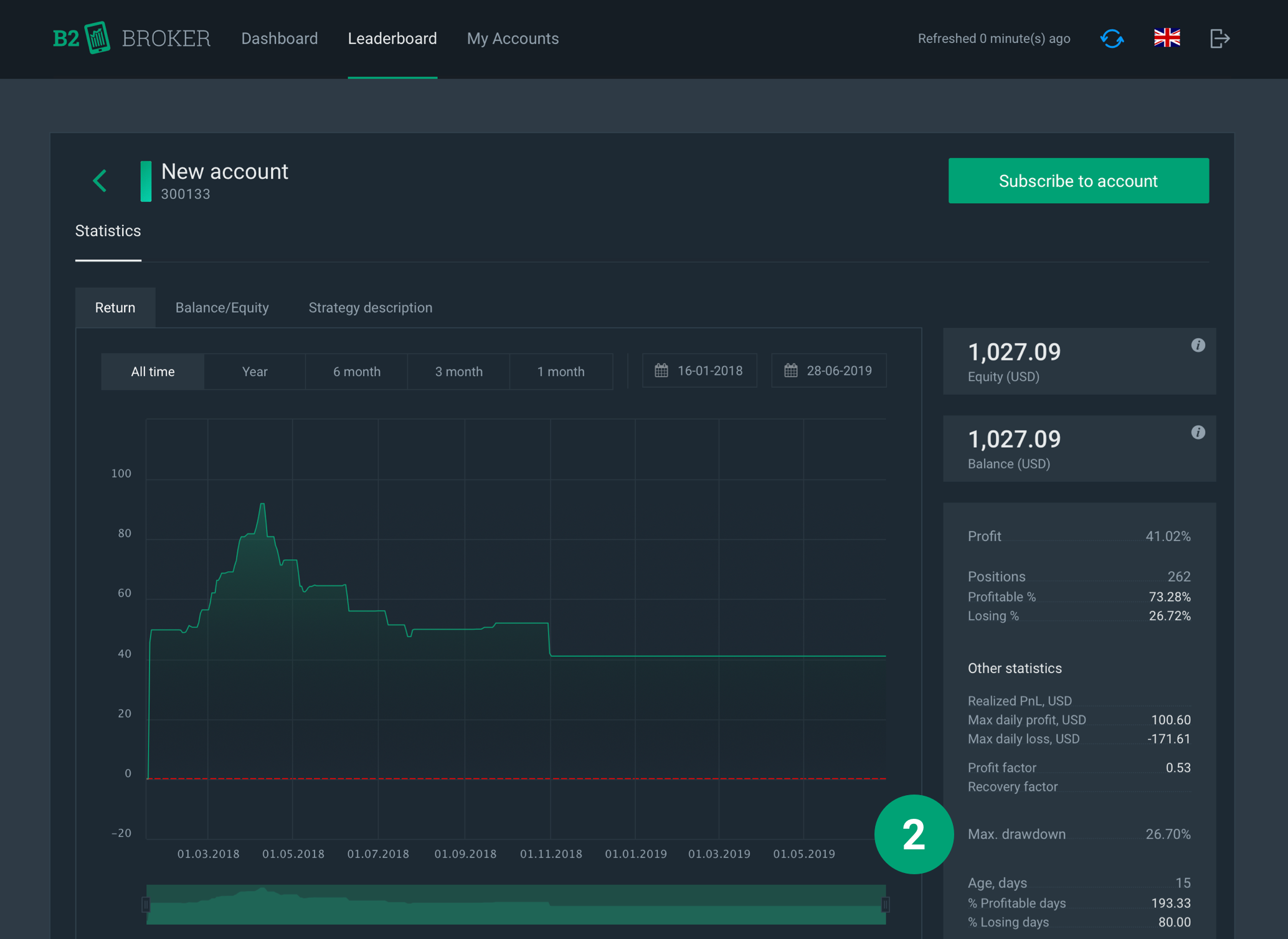

Where the maximum drawdown is shown

Leaderboard

Statistics page of each account

Formulas for maximum drawdown calculation

Investment platform has 2 built in formulas for calculation of Max DD and showing it to investors:

From High Water Mark of Return in %

From Net Deposit

Formula of maximum drawdown based on HWM of return

Return_Max_DD = ((Return_2+100)-(Return_1+100)/(return_1+100))*100%, where is

Return_1 — is Max Return in % since the beginning of the period (Peak)

Return_2 — is lowest Return in % since the beginning of the period till the end (Bottom)

Note

Most common formula in the world. Usually when somebody uses Max Drawdown term, he means the value calculated based on High Water Mark of the Return that is based on Equity.

Deposits and withdrawals doesn’t affect the value of Max DD based on that formula.

Formula of maximum drawdown based on Net deposit

NetDW_Max_DD = ((Lowest_Equity)-(NetDW)/(NetDW))*100%, where is

NetDW → Sum of deposits - Sum of withdrawals

Lowest Equity → Is lowest equity of account

To be more precise, It is calculated every single row in database, and the smallest value is saved as maximum drawdown.

Note

Withdrawals can affect the Max DD value and make it bigger.