Advanced features allocation types and modifications for money managers

B.I.G. idea

Our investment platform provides you unlimited opportunities for customizations for money managers’ needs.

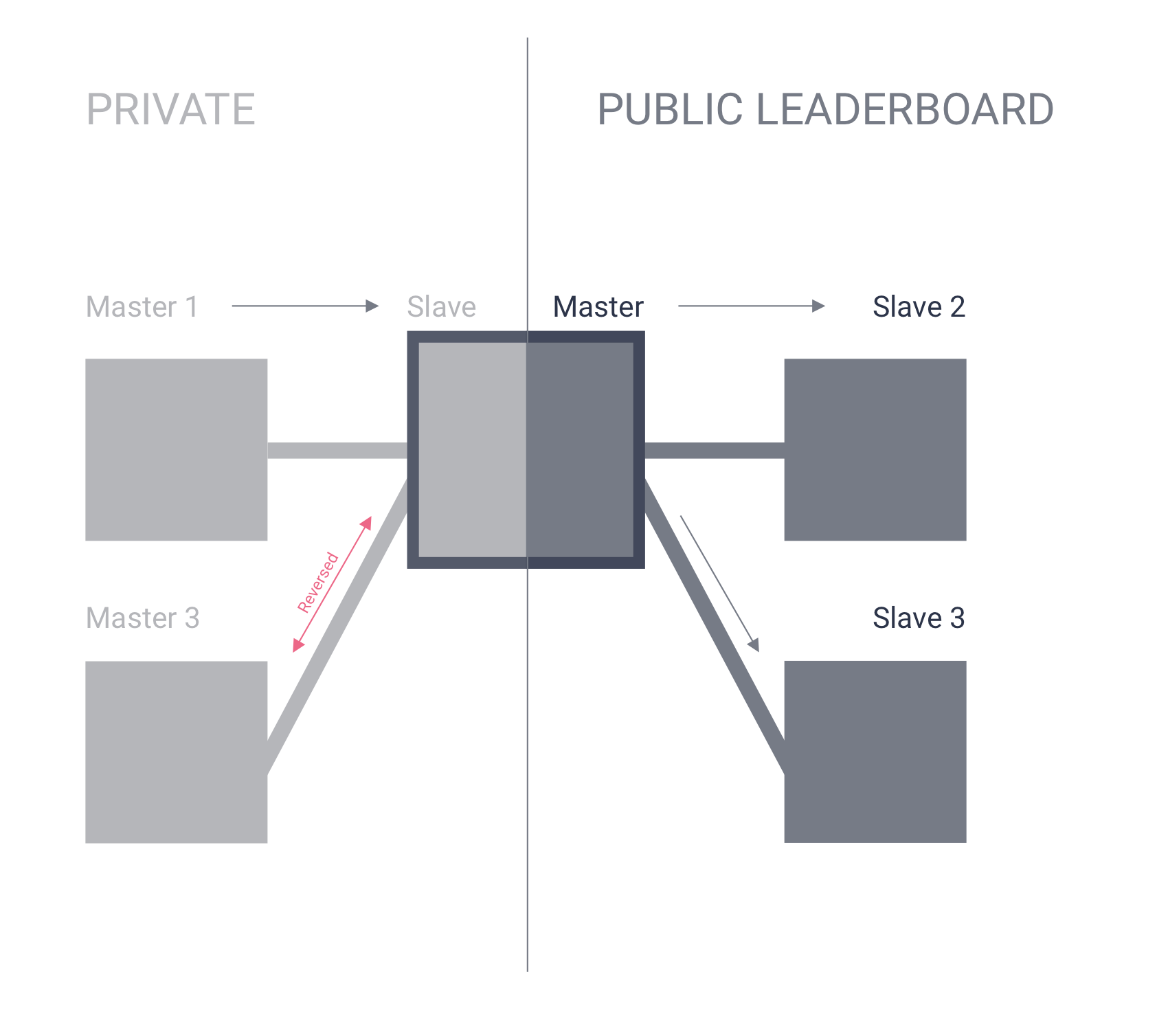

Most of that custom setups are based on one simple function: Account can be Master and Investor at same time.

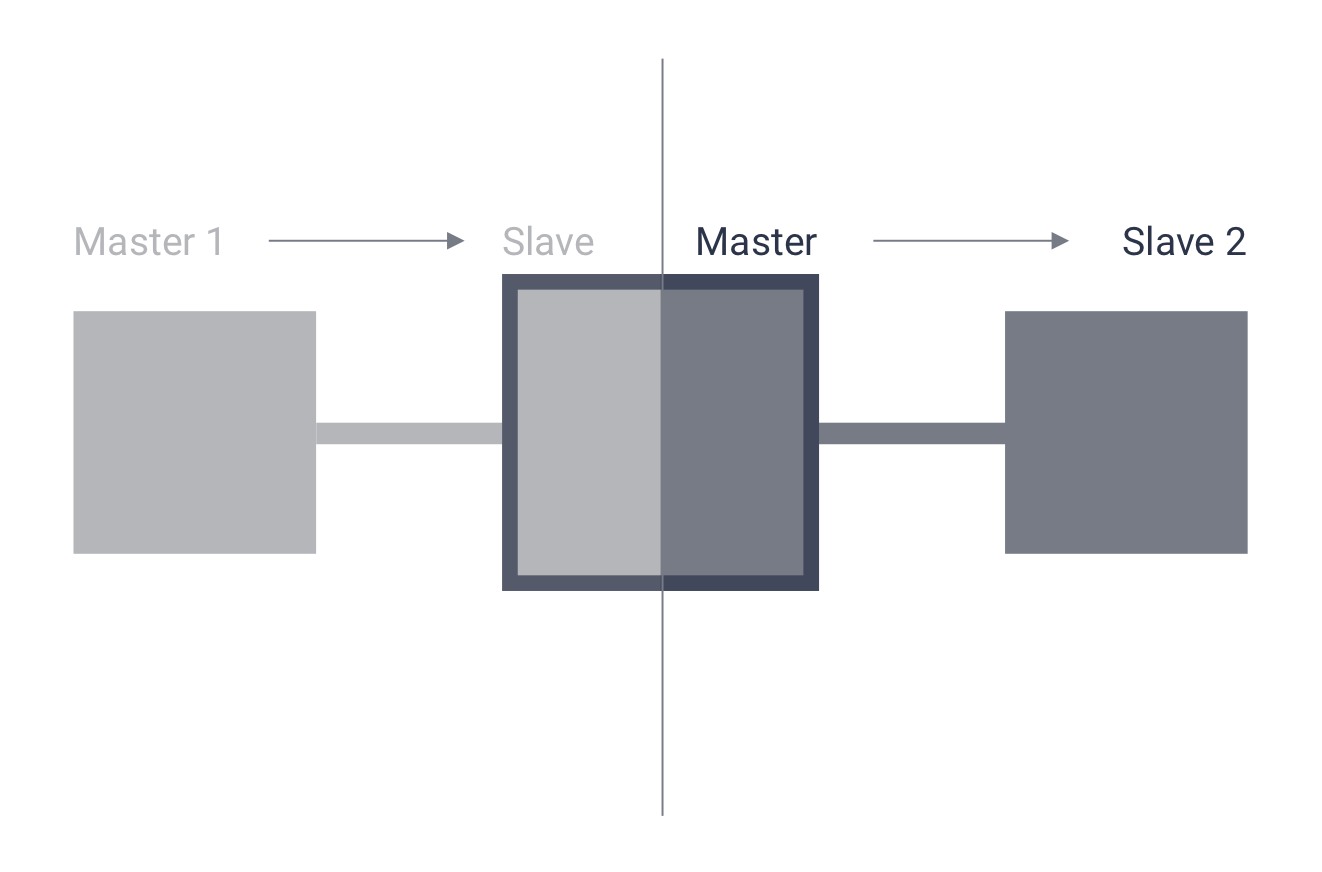

What does it mean

On a scheme above there is a setup for social trading: Account in grey box is a slave for MASTER 1, but on other hand it is a Master for SLAVE 2. That means that account in grey box copy trades from MASTER 1. On other hand SLAVE 2 copy positions from grey boxed account.

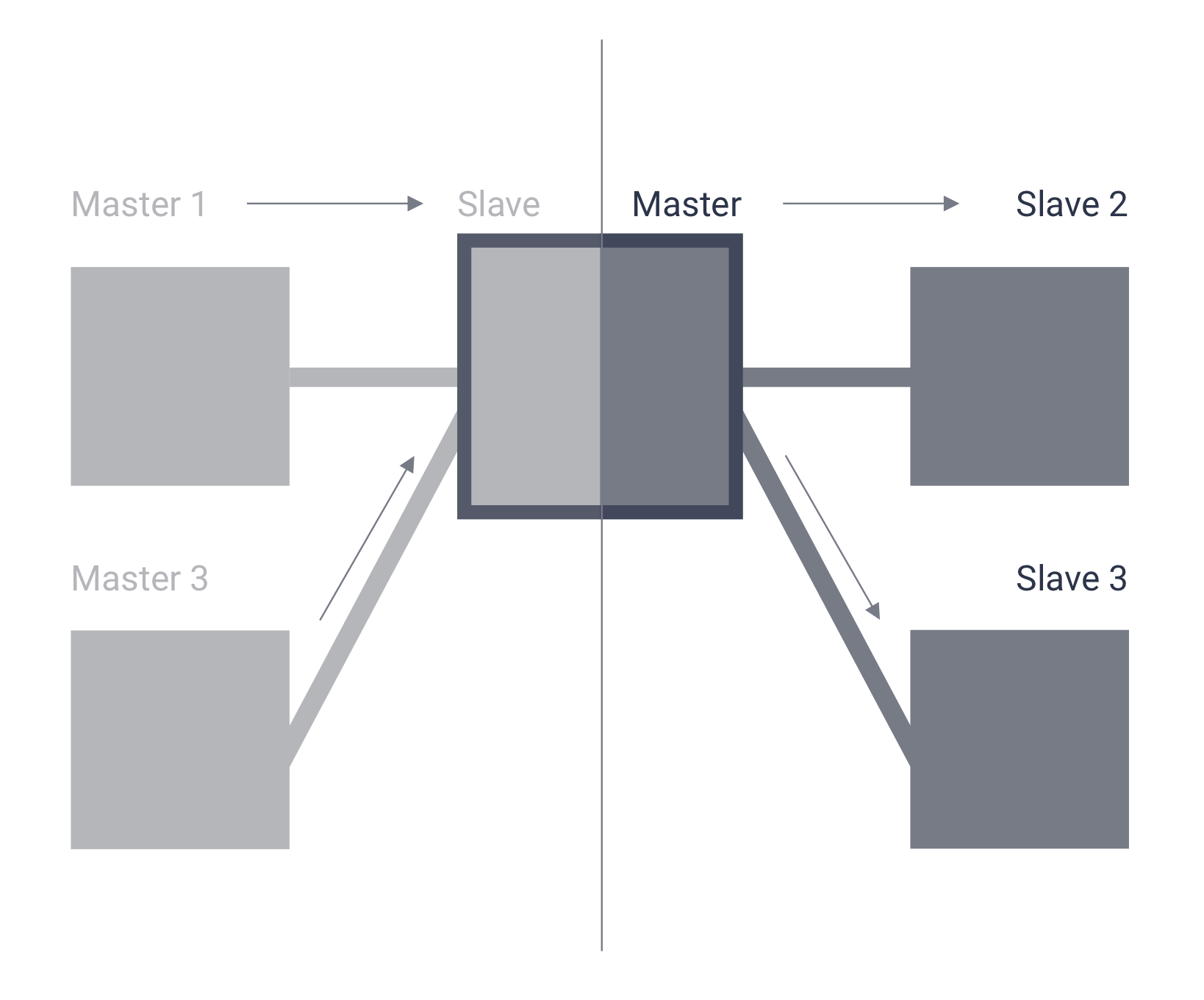

We can add more accounts in that copy-trading scheme as well:

In that case account in grey box acts like investment portfolio. It gets positions from MASTER 1 and MASTER 3 and others, so he get combined performance which is always more attractive than performance of only one master account separately.

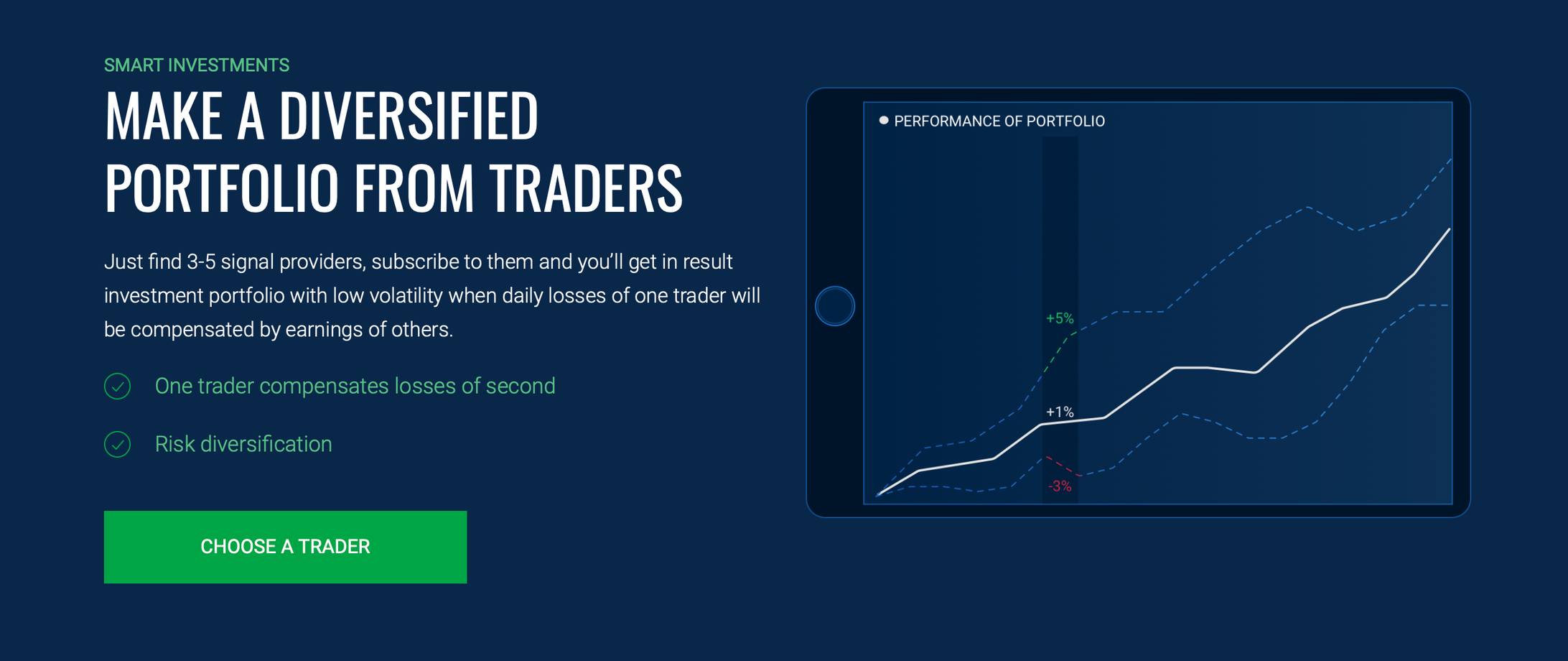

Why investment portfolio is attractive

Check the picture below: we have 50/50 split of money to 2 investors. One made +5%, second -3%. Combined we have 1% of profit.

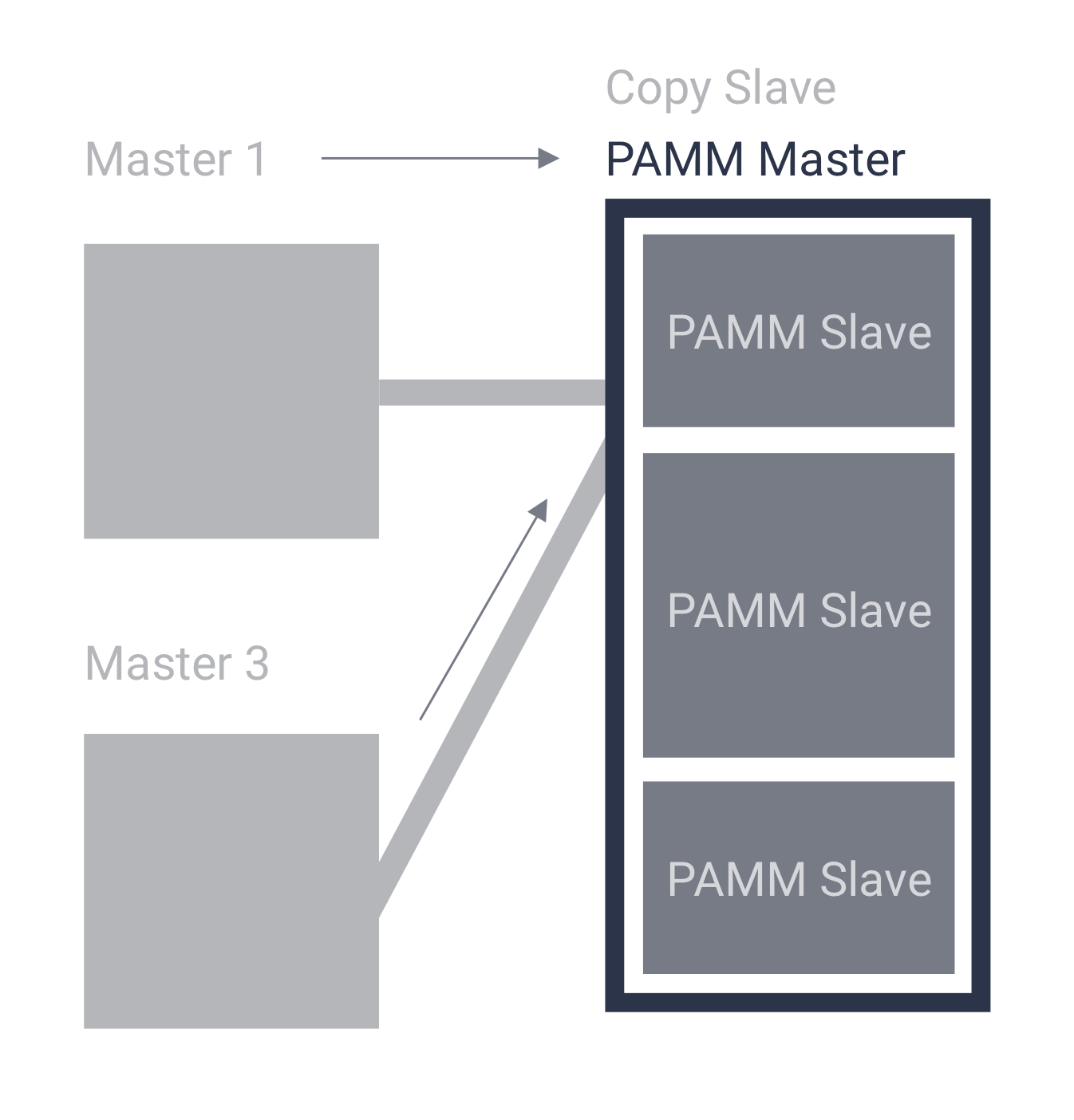

Other possible setups

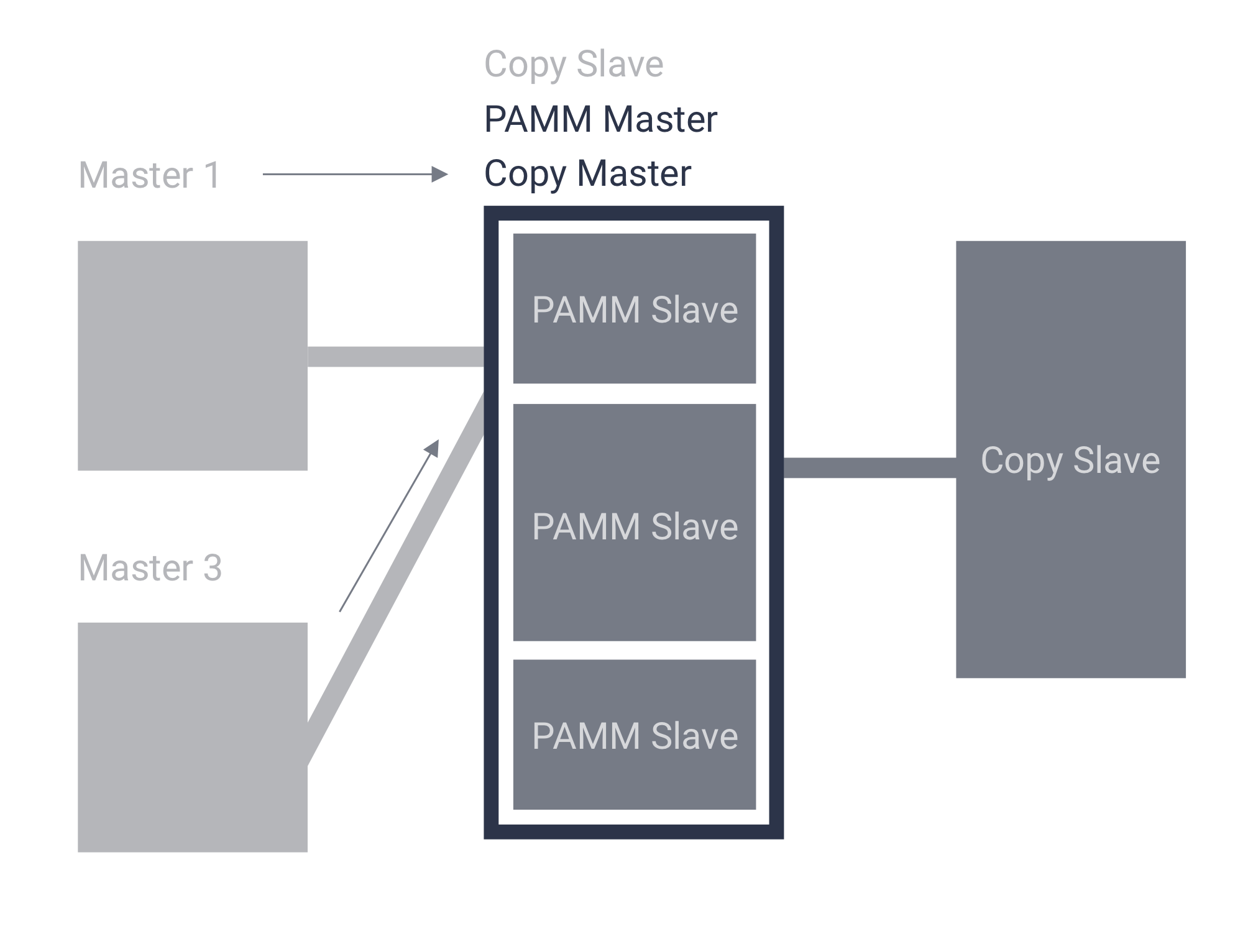

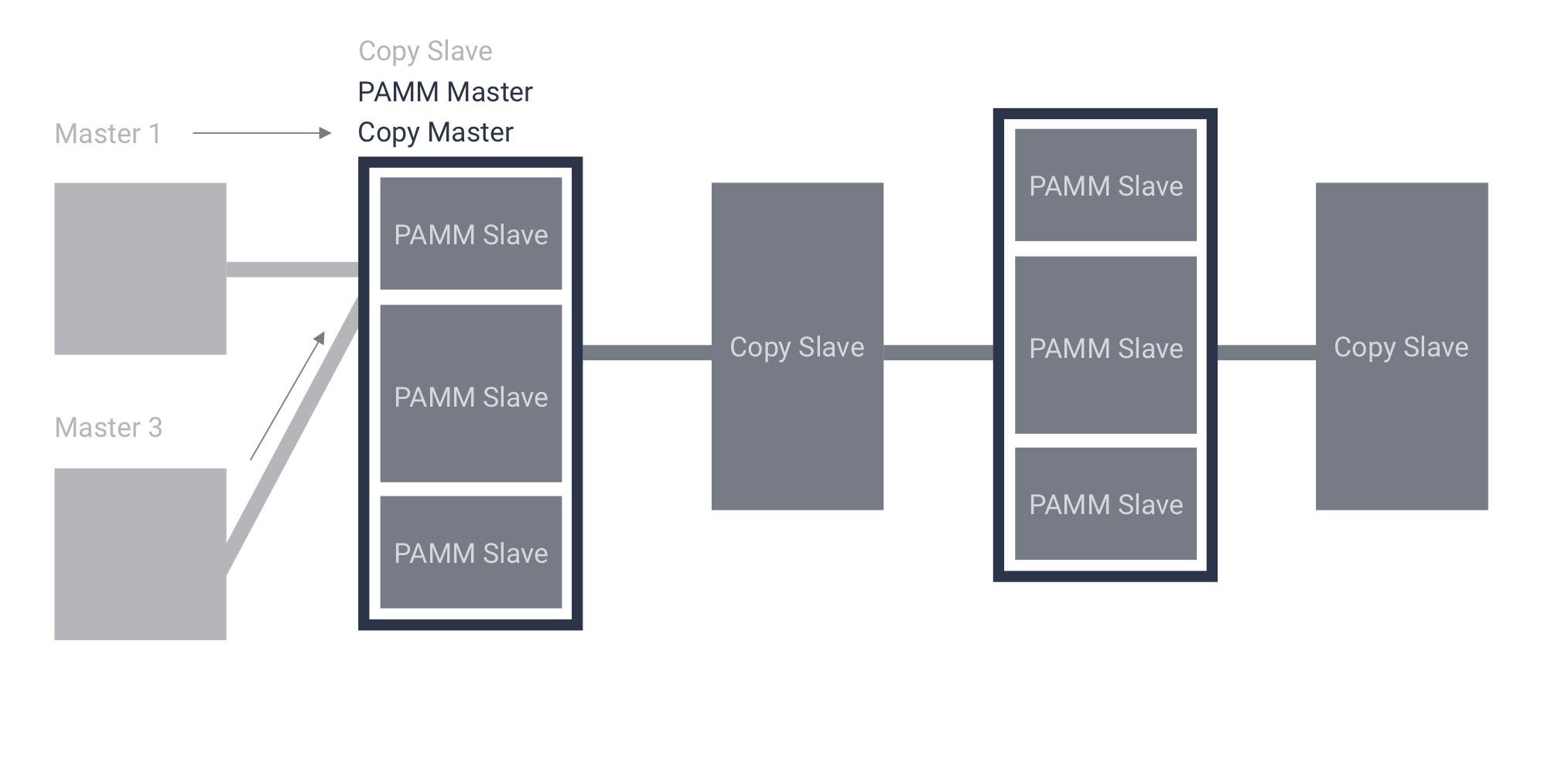

You can combine several account types in one setup: copy positions to PAMM master or copy positions from PAMM master. Or do both things simultaneously.

In that scheme big account acts like copy slave for MASTER 1 and MASTER 3, but as a PAMM Master for its slaves.

It’s even possible to make the following scheme:

In that case one account has 3 different roles: PAMM Master / Copy Master / Copy Slave.

So it receives positions from Copy Masters 1-3 and provides this signals to his copy slave + allocates profit from opened positions on himself to his PAMM slaves.

Note

You have no limits on number tiers or accounts in scheme and can make it as big as you want.

How that can be used

Allow small clients invest in funds with big min. deposit

Create investment portfolios from retail traders for leaderboard

Allow clients create investment funds with multiple traders

Tailored allocation modes for different clients within 1 master

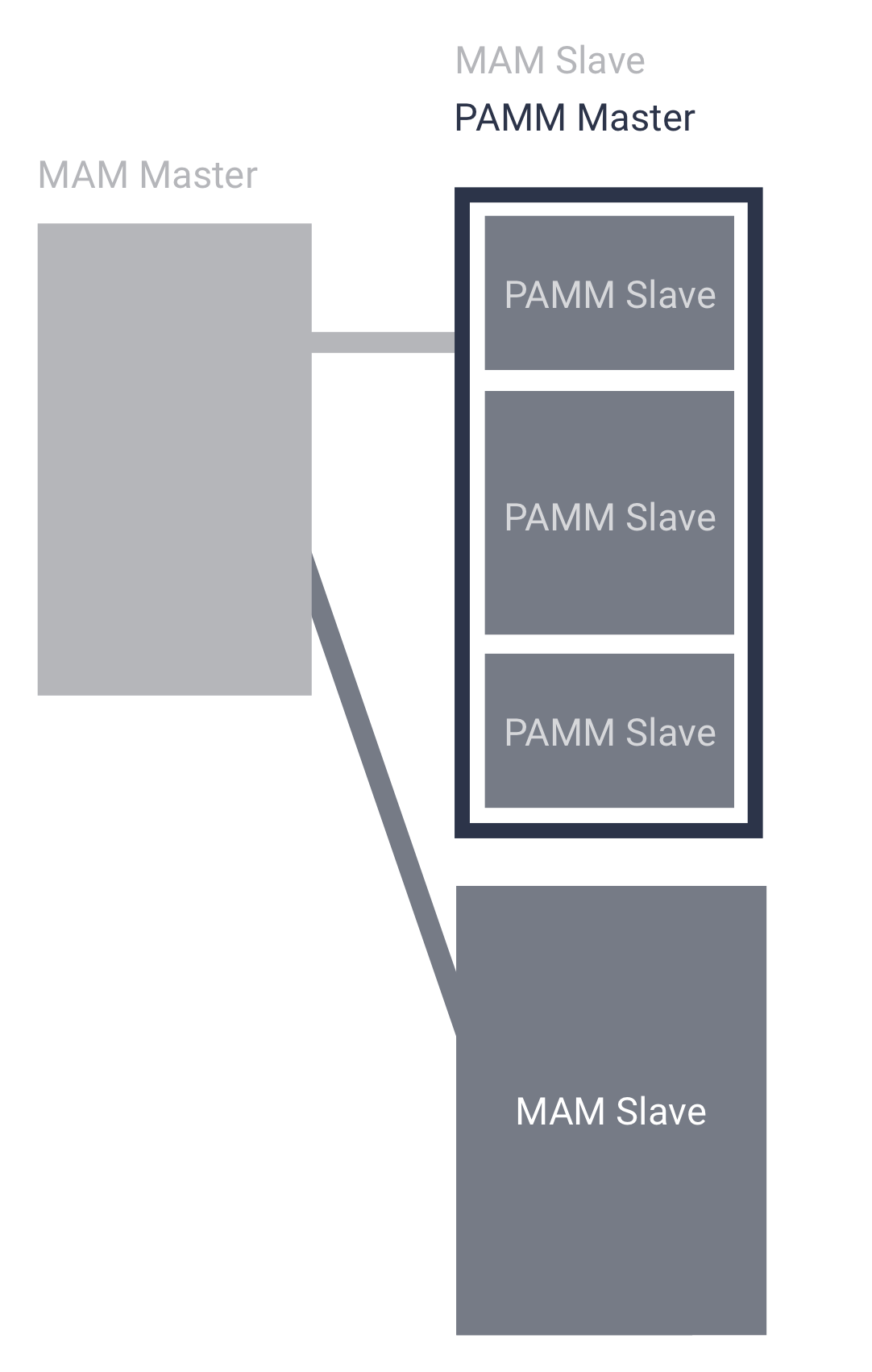

Allow small clients invest in funds with big min. deposit

Not all strategies are applicable for small accounts. e.g. You can not trade martingale based strategies on account with 100$.

So MAM manager can has its $30k-$40k investors as individual MAM investors, but broker can collect all his small retail clients with 300$-3000$ to same $30k PAMM account that is minimum required and copy trades on it.

PAMM will distribute PnL of positions to small investors proportionally to their shares in it with rounding to 0.01$.

Note

So with that combined scheme they get opportunity to invest in good money manager even when they have no money for minimum deposit.

Create investment portfolios from retail traders

All brokerage companies have lots of good and bad traders.

Some of people prefer to trade publicly and they will create master accounts on their own. But those who don’t want to manage smb else’s funds because of different reasons will never do it.

So you as a broker can create 10-20-30 master accounts in leaderboard and copy positions from your clients’ accounts to it in different proportions and directions.

You can copy as many traders to an account that will be a master in public leaderboard.

Good traders can be copied in same direction, bad traders reversed (trader opens BUY position but on slave copied SELL position).

Allow clients manage their investment funds with several traders

Main aim of good trader is to make a profit. He doesn’t need necessary care about millions of dollars behind him.

So CEO of a fund gives traders just demo accounts with 10000$ or 100000$, no matter here. And tells them: trade in profit and you will get monthly, weekly, yearly bonuses. That’s it.

So at the beginning picture looks like that:

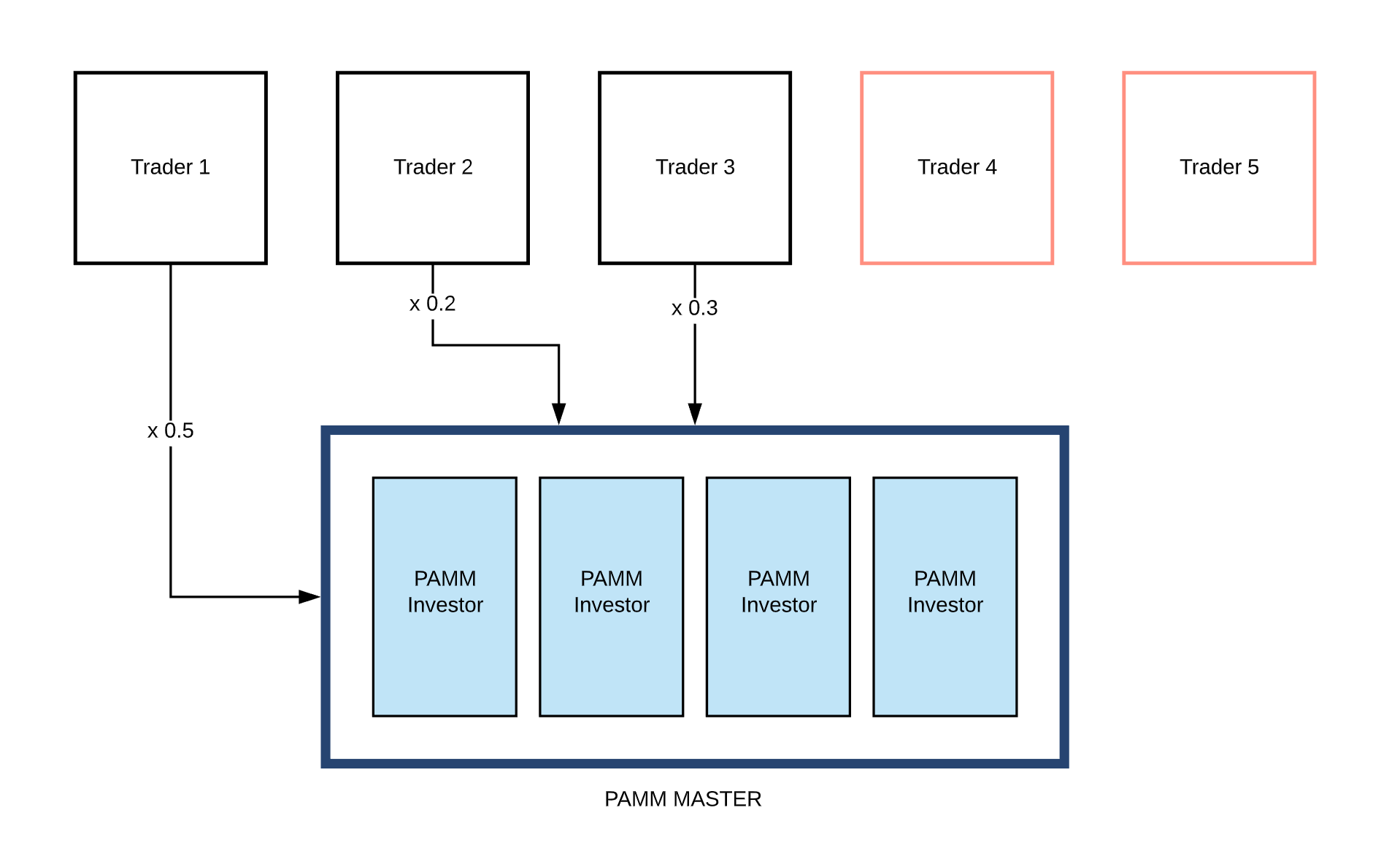

As time goes and traders pass testing periods, CEO of fund begin connect their accounts to account with real money.

He gives 50% of equity to Trader #1, 20% to Trader #2 and 30% to trader #3. Trader 4 and Trader 5 are not managing real money yet, just trading on demo.

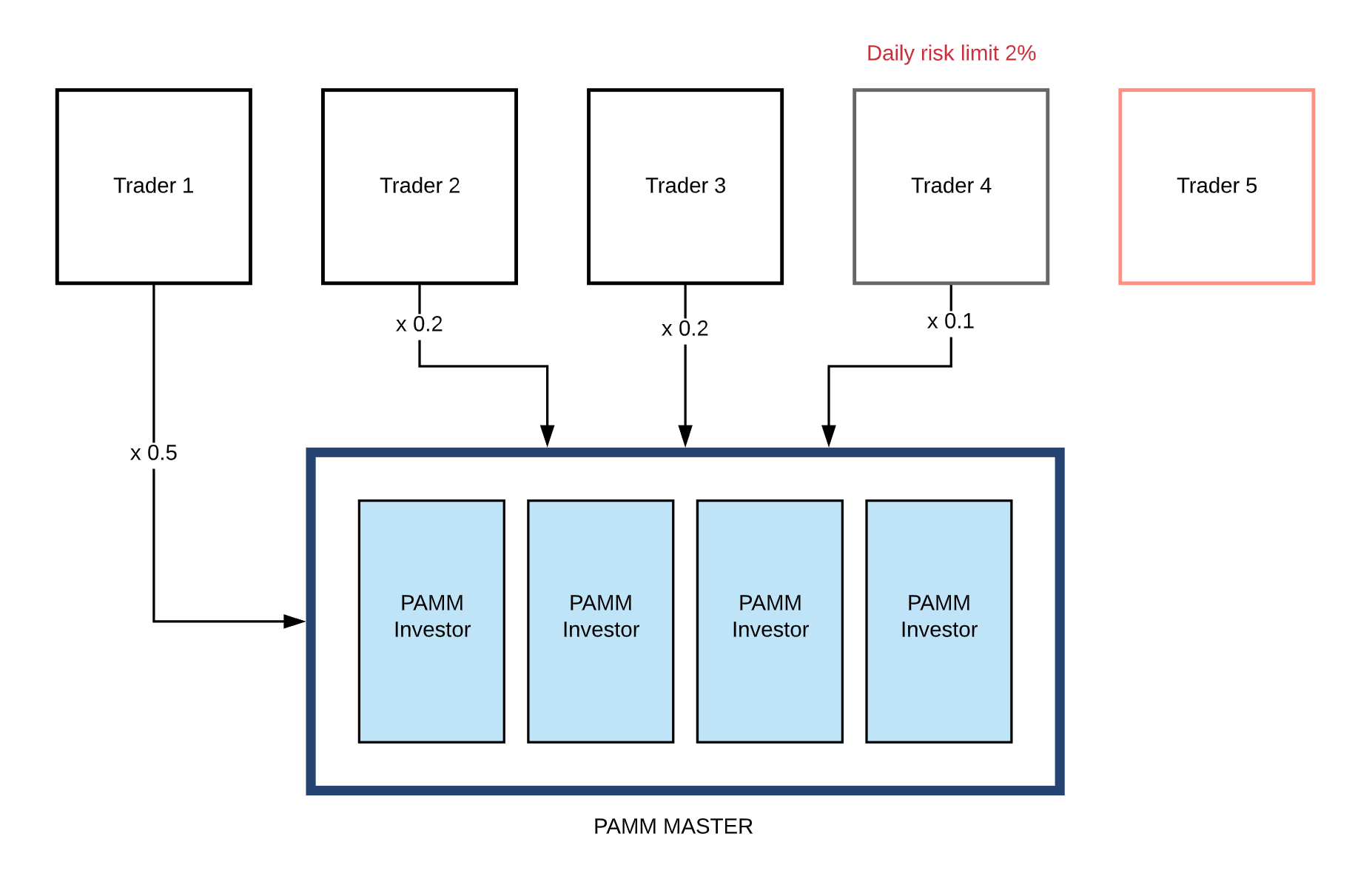

Again as time goes, Trader 4 also gets connected to main PAMM master account with clients’ money. But with small Daily risk limit and small share of money in management.

Note

CEO of fund can flexibly manage trader’s connections, close opened positions on client’s accounts and set automated risk limits to their accounts.

Our platform provides unlimited opportunities for institutional money management.