MAM accounts

MAM accounts are the best tool for managing pool of clients in a unique way. It was developed specifically for professional money managers and hedge funds managers.

BIG article about unique ways of using MAM

Main features

7 allocation methods

Activation / Deactivation of investors without closing positions

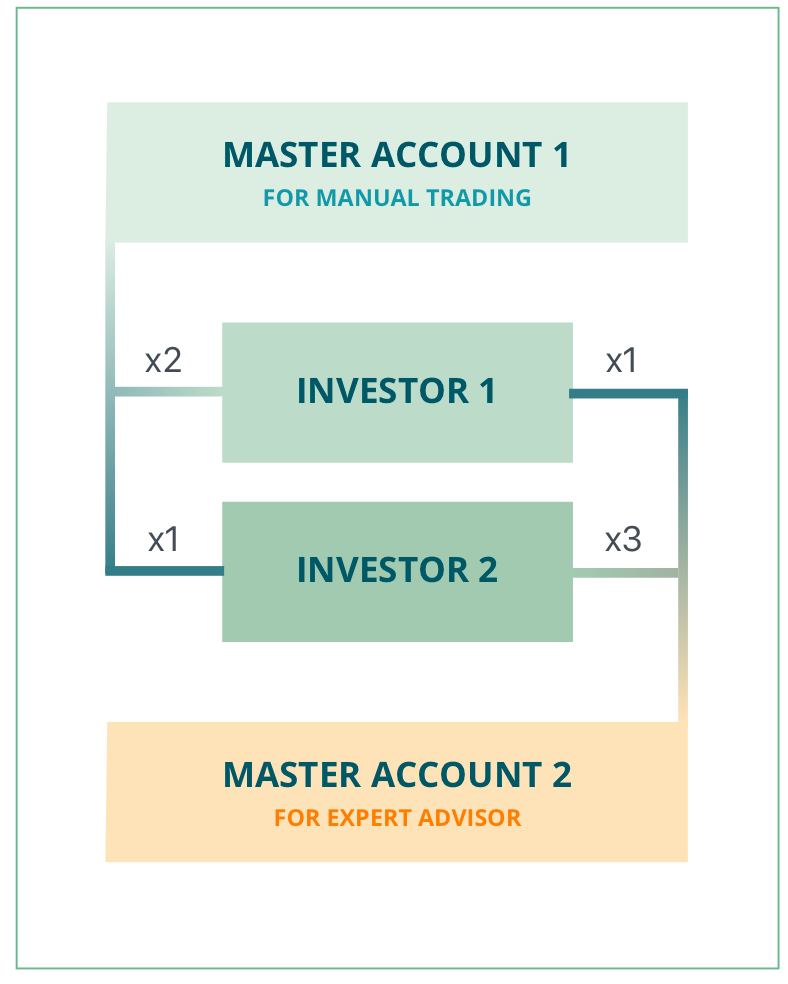

Trader can use several master accounts for managing his pool of investors

No need to create separate MT groups for each money manager

Fees for all investors can be set up separately

All fees are paid automatically

Money manager can use several master accounts for managing his pool of investors with different allocation methods, risk ratios and activated/deactivated investors

All investors in MAM are in read-only mode. Investors can not trade on them on their own

Investors can see their opened positions on their MT accounts.

Deposits and withdrawals don’t affect master account equity as accounts are separate.

Allocation methods for MAM

Proportionally by Balance

Proportionally by Equity

Proportionally by Balance x Ratio

Proportionally by Equity x Ratio

Proportionally by Free margin

Fix lot allocation

Ratio Multiplier

Formulas for allocation methods

Proportionally by Balance

Position of investor = Master position x (Investor's balance / Master’s Balance)

Proportionally by Equity

Position of investor = Master position x (Investor's Equity / Master’s Equity)

Proportionally by Balance x Ratio

Position of investor = Master position x (Investor's balance / Master’s Balance) x Ratio

Proportionally by Equity x Ratio

Position of investor = Master position x (Investor's Equity / Master’s Equity) x Ratio

Proportionally by Free margin

Position of investor = Master position x (Investor's free margin / Master’s free margin)

Fixed lot allocation

Position of investor = fixed lot (ratio)Position of investor is opened in the direction of master trade

Ratio Multiplier (sometimes called lot allocation)

Position of investor = Master position x Ratio