PAMM accounts

PAMM (Percent Allocation Management Module) accounts give the opportunity for all your traders to run their own investment funds.

Main features

All investment accounts are combined in the one trading account (master account = pamm account).

Only money manager can trade on PAMM account. Trading is disabled for investors.

All investors get share of PnL made on PAMM account proportionally to sizes of their accounts.

Can work as social investment tool with money managers shown in the Leaderboard and as institutional investment tool (MAM) when broker subscribes investors to master accounts.

Several execution options are available, including autocorrection of master’s positions on withdrawals.

Automated rollovers for deposits and withdrawals processed by the individual schedule.

No need to close master positions during subscriptions / unsubscriptions / deposits or withdrawals.

Fees for all investors can be set up separately.

Automated subscriptions / unsubscriptions of investors.

Investors can not see any opened positions in their MT5 terminal.

Investors can see their performance and current equity including floating PnL of their investment accounts in web interfaces.

All PnL is distributed to invesment accounts with 0.01USD/EUR/GBP precision (min available part of base currency of investment account).

Allocation of positions in PAMM accounts

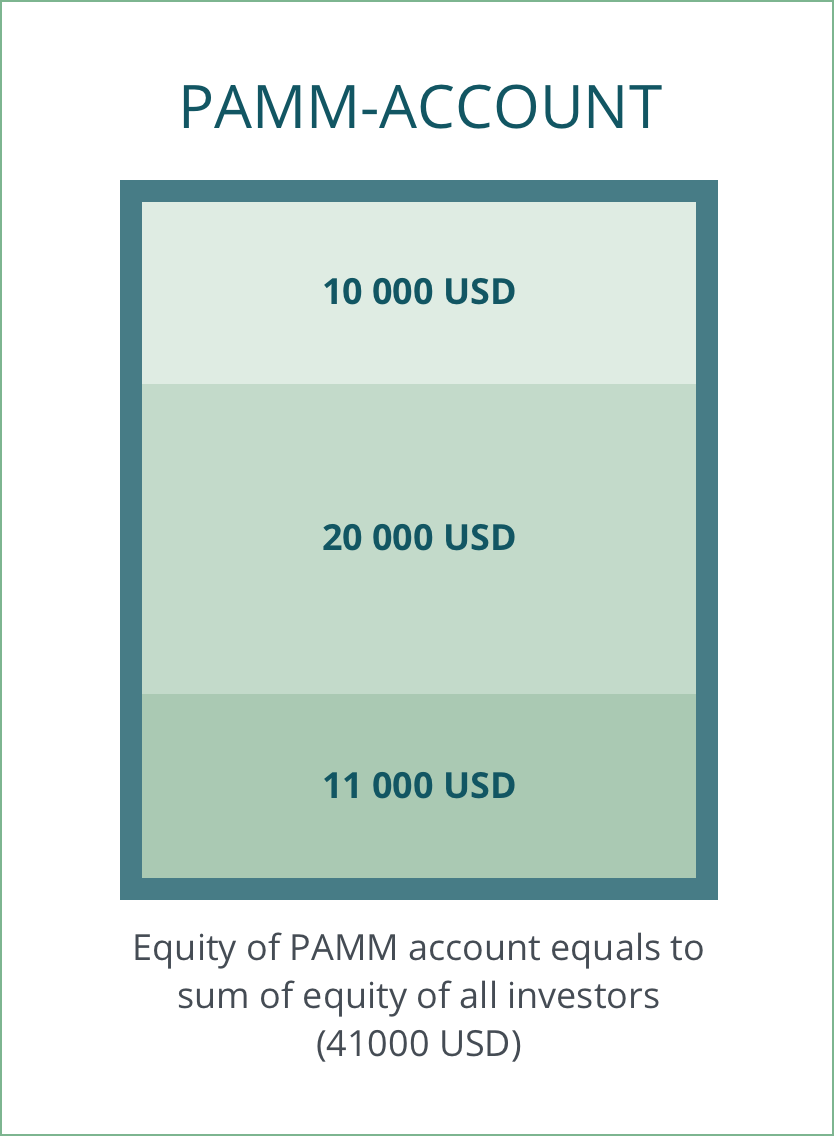

Master account (PAMM account) consists of investment accounts (Equity of PAMM account = sum of equities of investment accounts).

Only Money manager can trade on master account.

When money manager makes trades they doesn’t appear on investment account.

When money manager closes positions investors get balance operations with their share of PnL for that position.

Formula for calculation of PnL for investment account

PnL of investor = Closed PnL for master position x (Investor's Equity / Master’s Equity)

Example

PAMM account = 10000 USD

Investment account #1 = 1000 USD

Investment account #2 = 2000 USD

Investment account #3 = 7000 USD

Step 1: Master opens BUY 1 lot EURUSD @1.2110. Nothing is opened on investment accounts.

Step 2: Master closes 1 lot EURUSD @1.2120. Closed profit = 100USD.

Step 3: Investor #1 gets balance operation with 10USD. Investor #2 gets balance operation with 20 USD profit. Investor #3 gets balance operation with 70USD profit.

Behavior of PAMM accounts during deposits/withdrawals

When somebody makes Deposit/Withdrawal (DW) shares of investment accounts are recalculated accordingly to new shares of investment after DW. After DW lblin label creates for all opened positions on master account and all floating PnL for all master positions is redistributed by balance operations to investment accounts.

Example

Initial state:Master account = 1000USD. it has only 1 investor with 1000 USD

Step 1: Master opened BUY 1 lot EURUSD @1.2110.

Step 2: Investor #2 subscribed and deposited 2900 USD when EURUSD was @1.2120.

Step 3: Investor #1 got balance operation with floating PnL at the moment of DW: +100USD

Step 4: Master closed position @1.2110.

Step 5: Investor #1 got a balance operation with his share of PnL between DW and closing of position: -27,5 USD (-100USD x (1100/4000). Investor #2 got his share of PnL: -72,5USD

Additional options of execution

Autocorrection of master positions on Withdrawals.

Deposits without rebalancing of positions.

How autocorrection works

Autocorrection helps a money manager automatically save the same leverage (or margin level) that was on the account before a withdrawal by partially closing opened positions.

Important

Autocorrection always results in closing each open position on a master account by at least the minimum trading volume that is defined for an instrument.

For example, we have PAMM account (4000USD) with 2 investors: 1000USD (25%) and 3000USD (75%). He has 1 lot EURUSD opened position.

Then investor #2 withdraws 2000USD.

Before withdrawal investor #1 had virtual position: 0.25 lot EURUSD and investor #2 0.75 lots respectively.

With autocorrection Master position will be partially closed by autocorrection proportionally to withdrawal amount >>> 2000USD/4000USD x 1 lot >>> 0.5 lots will be closed.

So after withdrawal investor #1 will get same size of virtual position: 0.25 lot same as investor #2 (they have same equity).

Without autocorrection Positions of money manager will not be affected but investors will get new shares in PAMM after withdrawal: investor #1: 50% and investor #2: 50%.

So both investor #1 and investor #2 will get 0.5 lots of EURUSD after withdrawal.

Note

That means that leverage for investor #1 increased by 2 because of actions of investor #2.

We implemented rollovers to eliminate such surprises because of withdrawals or deposits even on model without autocorrection.

Money manager can set a schedule for deposits and withdrawals, so he knows when exactly will be executed DW requests and how much money investors plan to deposit and withdraw.

He can make set a schedule for rollovers in settings of master account in his account settings in Web UI.

Deposits without re-allocation of positions

For example, we have PAMM account (4000USD) with 2 investors: 1000USD (25%) and 3000USD (75%). He has 1 lot EURUSD opened position.

then investor #2 deposits 4000USD.

Before deposit investor #1 had virtual position: 0.25 lot EURUSD and investor #2 0.75 lots respectively.

After deposit their virtual positions will not be changed. Investor #1 will have same 0.25 lots and Investor #2 will have 0.75.

It is highly recommended not to use that feature because of 2 side effects:

Performance of master account will be different from performance of investment accounts (as positions were not rebalanced)

Master account will have bigger margin level then investor #1, so investor #1 can hit stop-out earlier than master